Shanghai, February 28, 2025 – Fashion Exchange, in collaboration with CBNData, has officially released the 2024 Fashion IP 100. Since their first partnership in 2019, this marks the sixth consecutive year of their joint effort to evaluate the performance of global fashion IPs in the Chinese market.

The ranking offers a data-driven snapshot of Chinese consumer preferences and brand choices by analyzing online shopping data, search engine trends, and social media engagement over the past year. This ranking not only reflects shifting fashion trends in China but also provides valuable insights for global brands looking to understand and engage with the Chinese market. Over the years, this ranking has become a crucial bridge between global fashion brands and the Chinese market.

Against the backdrop of slowing global economic growth and heightened geopolitical tensions, In 2024, China’s fashion market underwent a significant transformation, with a growing divide between luxury spending and affordability-driven choices. As consumers adopt a more rational approach to spending, they are shifting away from logo-driven purchases toward a 'quality-to-price revolution' that emphasizes both value and emotional appeal.

Simultaneously, the evolution of aesthetics and spiritual needs has driven the rise of style-driven consumption, while economic fluctuations and a more cautious spending mindset have led consumers back to the essence of consumption—where brands serve as a means of self-expression rather than symbolic status performance. As a leading global platform for fashion designers and artists, Fashion Exchange pioneered the concept of Fashion IP in 2017, establishing a collaboration model centered on Fashion IP Empowering Business. With product innovation at its core, Fashion Exchange collaborates with fashion IPs to help brands across various industries launch "first-to-market" products in China and create impactful buzzworthy events, ultimately achieving both brand visibility and sales success.

By analyzing the 2024 Fashion IP 100, we focus on key ranking shifts, regional and national trends, and category evolutions to uncover emerging consumer preferences and forecast future industry movements.

Key Insights from the 2024 Fashion IP 100

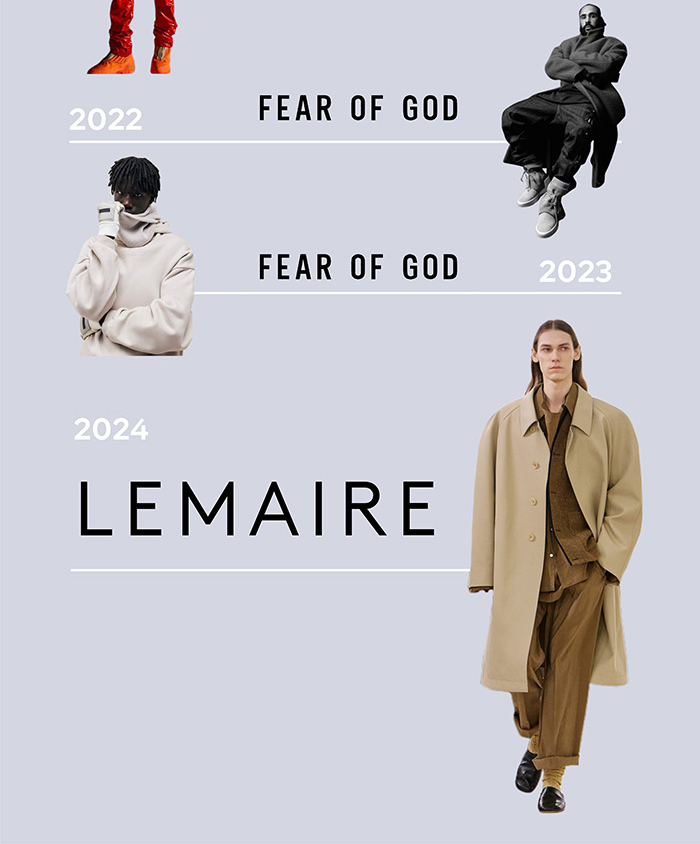

1. From Streetwear Hype to Refined Style: Lemaire Takes the Top Spot

For the first time, French designer brand Lemaire has topped the ranking, marking a significant shift in Chinese fashion consumer preferences—from streetwear dominance to refined aesthetics. This marks Lemaire’s first entry into the overall Top 10 since its debut on the list in 2021, making it the fourth fashion IP to claim the No.1 spot in the six-year history of the ranking. Lemaire’s rise to the No.1 spot signals a move from street culture obsession to personal style curation.

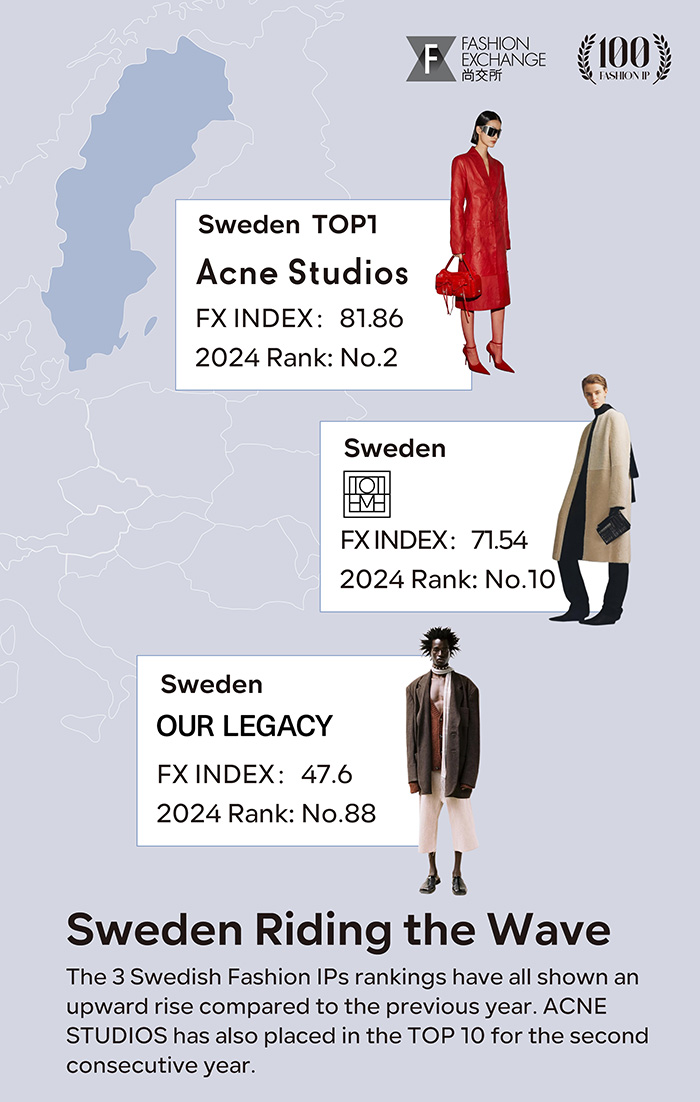

Swedish brands Acne Studios and Toteme, American label The Row, and South Korean brand Low Classic have all gained traction in this evolving trend. In fact, Lemaire, Acne Studios, and Maison Margiela occupy the top three positions. The transition from Supreme to Lemaire at the top of the rankings marks a fundamental reset in consumers’ decision-making—from a fear of being unnoticed to a preference for being truly understood. Effortless style is emerging as a cooler, more meaningful statement than trend-driven symbols.

2. The Rise of Niche Designer Brands, Decline of Streetwear and Celebrity-Led Labels

While luxury brands grappled with slower sales and leadership changes, independent designer brands surged in popularity. Lemaire has expanded globally, opening stores in Seoul, Tokyo, and Chengdu over the past two years. In November 2024, OUR LEGACY secured investment from LVMH Luxury Ventures, while The Row completed its first funding round, reaching a valuation of $1 billion USD. Meanwhile, Jacquemus signaled expansion efforts, seeking new investors.

This shift is also reflected in the 2024 ranking, where designer-led brands account for 75% of the list—the highest proportion in the history. For the first time in the ranking’s history, all Top 10 positions are held exclusively by designer fashion IPs.

Conversely, streetwear brands have lost momentum. In July 2024, Supreme changed ownership, with VF Corp selling the brand for $1.5 billion USD to EssilorLuxottica. In October, LVMH offloaded Off-White, and in November, New Guards Group (NGG)—parent company of Palm Angels, Ambush, and Unravel Project—filed for bankruptcy protection.

Similarly, celebrity-founded fashion brands have seen a decline, with only 15 making the list, a record low for this category.

3. The Dominance of the U.S., China, Japan, and France—But No Chinese Brands in the Top 10

Fashion IPs from China (24), the U.S. (26), Japan (16), and France (13) make up nearly 80% of the list. Notably, France saw the most significant rise, increasing from 9 brands in 2023 to 13 in 2024, with two in the Top 3: Lemaire (No.1) and Maison Margiela (No.3).

Despite the strong performance of Chinese brands, with seven more entries than in 2023, it is the first in six years without a Chinese fashion IP in the Top 10. While 16 new brands debuted on the list, only 9 were from China, including RUI, M Essential, Chen Fen Wan, DIDU, and D.Desirable (by actor Dylan Wang).

However, one standout was CLOT, founded by Edison Chen, which ranked No.1 among Chinese fashion IPs and maintained its position as the most searched designer brand IP in China for six consecutive years.

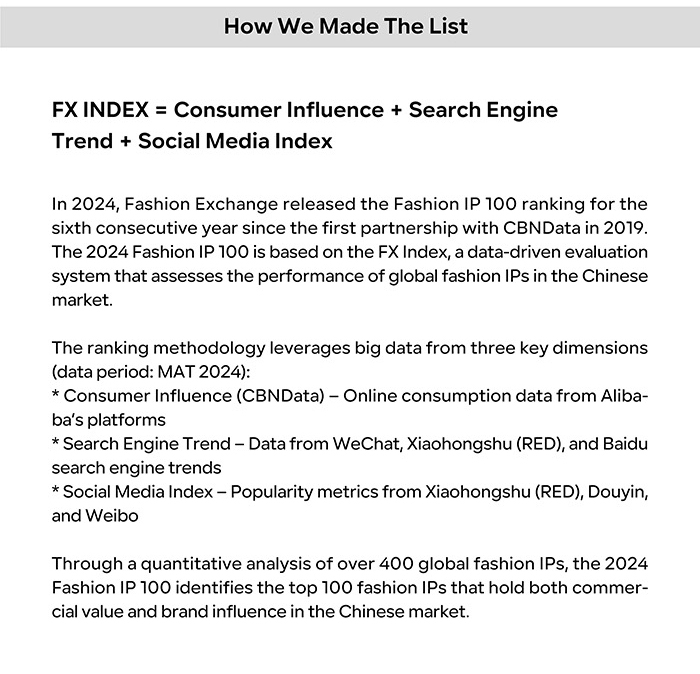

About the Fashion IP 100 and FX Index

In 2019, Fashion Exchange introduced the FX Index, a quantitative evaluation system for fashion IPs, and the Global Fashion IP 100 ranking. These benchmarks have become widely referenced by global media, fashion brands, and industry insiders.

By integrating data from CBNData’s consumer influence metrics (Alibaba e-commerce data), social media platforms (Xiaohongshu, Douyin, Weibo), and search engine trends (Wechat, Xiaohongshu, Baidu), the ranking provides an authoritative, data-driven insight into the evolving Chinese fashion landscape.

For brands looking to better understand Chinese consumer preferences, craft effective product and marketing strategies, and create high-impact collaborations with fashion IPs, the FX Index and Global Fashion IP 100 serve as essential industry guides.

About Fashion Exchange

Fashion Exchange is a global platform for collaboration among fashion designers and artists. In 2017, with the support of the Council of Fashion Designers of America (CFDA), Fashion Exchange pioneered the concept of Fashion IP, establishing a brand collaboration and crossover model centered on Fashion IP Empowering Business. To date, Fashion Exchange has partnered with over 200 top global designers and artists, creating successful collaborations and campaigns for renowned brands, including Fila Fusion x Team Wang Design, Absolut x SR_A, Alexander Wang x McDonald's, and more.

Since 2019, Fashion Exchange, in collaboration with CBNData, has released the global Fashion IP ranking Fashion IP 100 for six consecutive years, alongside the independently published Global Fashion IP White Paper, which highlights annual trends and best practices in fashion collaborations.

复制成功!