Feature 5. Outdoor

I learned and understood the idea of putting ‘design’ first while working at Issey Miyake.

Keita Ikeuchi, Founder of and wander

Overview 2023

As Chinese consumers’ fitness awareness grows in the post-pandemic period, China’s outdoor sports industry is expected to usher in a “period of rapid growth”. ANTA Group’s third growth engine, represented by outdoor sports, has been gaining great momentum. According to its financial report, the group generated revenue of ¥29.65 billion in the first half of 2023, a 14.2% increase over the previous year. The retail sales of Descente and KOLON SPORT in the “other brands” category achieved a 45–50% YoY increase in the third quarter. Amer Sports, the owner of brands such as Arc’teryx and Salomon, also recorded its best financial performance in the first half of 2023 since the acquisition, with revenue rising 37.2% year-on-year to ¥13.27 billion. During the first three quarters of 2023, Toread realized revenue of ¥931 million, a year-on-year increase of 24.32%; net profit attributable to shareholders of the listed company amounted to ¥46.08 million, up 306.36% year over year. Camel’s operating revenue increased by 7.7% year over year to around ¥10.312 billion in the first three quarters of 2023; net profit attributable to shareholders of the listed company was approximately ¥401 million, up 33.86% from the previous year. American apparel giant VF Corp., which owns outdoor and pop brands such as The North Face, Vans, Timberland, and Supreme, announced its financial results for the second quarter of fiscal year 2024 (ended September 30, 2023), showing a further net loss to $451 million. The North Face’s sales revenue increased by 19% year-on-year and achieved 8% year-on-year growth in Greater China, making itself the only brand that achieved positive growth among VF Corp.’s four main brands. As of September 30, Columbia’s net sales had risen by 3% year over year, while its net profit had fallen by 7%. Meanwhile, its net sales in China increased by about 25%, according to the company’s financial results for fiscal year 2023. After 50 years of staying private, Patagonia remains one of the most sought-after outdoor brands, valued at $3 billion and hailed by Fortune as “the coolest company on the planet.”

Challenge

• The difficulty to strike a balance between “youthfulness and fashionability” and “functionality and professionalism.”

• The return of diverse offline entertainment after the pandemic was accompanied by the cooling of the public’s passion for outdoor sports.

• The risk of losing high-net-worth customers due to aggressive market expansion may impact the original premium niche positioning.

According to the China Outdoor Sports Industry Development Report (2022-2023) released on October 27, China’s outdoor sports industry has gradually recovered from 2022 to 2023 and the market size has surpassed its pre-pandemic level, bringing a historic opportunity. Simultaneously, the number of outdoor sports companies has significantly increased, with a shift in the consumer demographic towards a younger age group, and women gradually becoming a major consumer force. As market potential unfolds, industry competition intensifies, and consumer demands for products that combine "functionality and design" have risen. With the recovery of offline entertainment scenes, the general public is gradually returning to leisure activities such as travel, concerts, music festivals, and exhibitions, causing a relative cooling of outdoor sports. This shift challenges outdoor brands that have actively expanded their mainstream customer base in recent years, putting them at risk of slowing growth. Meanwhile, moving towards the mass market has impacted the original positioning of being high-end and niche, resulting in the loss of some high-net-worth customers. For outdoor enthusiasts, the brand's transition towards fashion also signifies a partial weakening of professional performance, coupled with pricing strategies, putting brand loyalty to the test.

Action

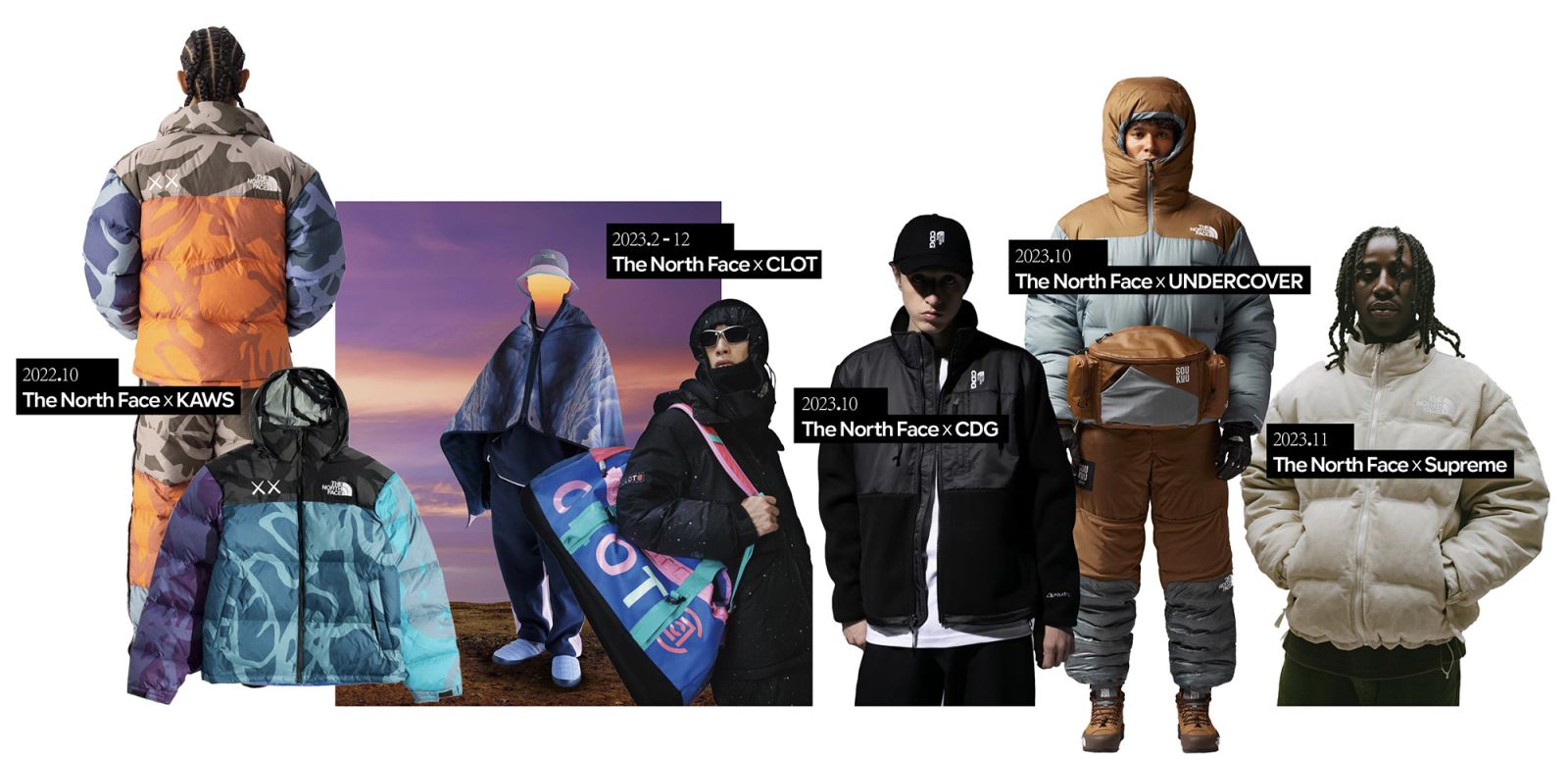

In November 2023, a video of Big Ben in London “wearing” a The North Face (after this referred to as “TNF”) puffer jacket went viral on social media. TNF provides a referential paradigm as one of the first outdoor brands to tap into pop culture and transit into a trendy brand. In recent years, TNF has collaborated with many fashion brands and artists, including Supreme, KAWS, UNDERCOVER, CDG, CLOT, and sacai, to provide young consumers with reasons to buy and let social media have stories to tell by riding on the Gropcore trend born with outdoor sports. It has also developed the Urban Exploration line for urban-outdoor consumers to further consolidate the brand’s position in younger and trendier markets. Additionally, international and local celebrities, supermodels, and fashion bloggers have been spotted wearing TNF products, making these products evolve from functional outdoor sportswear into must-have fashion items. As of mid-December, there were more than 110,000 posts with the hashtag #TNFpufferjacket# on Xiaohongshu, attracting over 200 million views. Salomon is also actively exploring its fashion potential through fashion collaboration. It is worth noting that the brand’s fashionization is based on the premise of retaining the high performance and outdoor attributes of its footwear. Salomon has also skillfully enhanced the styling capabilities of its products with stylish color schemes and gained endorsements through fashion brand partnerships and fashion show presence. In February 2023, Rihanna's appearance at the Super Bowl wearing sneakers from Salomon x MM6 Maison Margiela’s second collection catapulted to the top of Weibo’s hot search list with more than 94.74 million views, leading to another buying spree on their October drop. Unlike TNF and Salomon, Arc’teryx is a high-end outdoor brand for which the high-net-worth customer base is a major source of income. In addition, the target audiance of the brand act as an opinion leader group in the mass consumer market, which makes it more prudent in expanding its clientele. On the one hand, Arc’teryx, by constructing a product line that caters to the diverse needs of professionals, business individuals, and those adapting to outdoor and urban settings, strategically encompasses a broad spectrum of customer segments. Simultaneously, the brand continually enhances its technological advantages to solidify its position as an expert in the field. On the other hand, Arc’teryx collaborates with brands such as PALACE, JIL SANDER, BEAMS, etc., whose values align with its own, to create collaborative series that contribute to both product innovation and the enhancement of brand strength. Following a marketing approach centered around "experience, ambiance, and product", the brand has garnered widespread acclaim. In March 2023, Arc’teryx launched the co-branded Kawagarbo Series with its long-term partner Songtsam, a luxury boutique hotel group. The collection was immediately sold out, with some of the pieces selling for as much as 118% more on the secondary market. In April, Arc’teryx Beta unveiled its third co-branded collection with Japanese fashion label BEAMS, which fetched a premium of over 140% on the secondary market.

GROWTH in 2024

Leveraging “hardcore competitive power”, including R&D investment to improve product functionality and supply chain optimization to improve production efficiency and cost control, has always been a core proposition for outdoor brands. However, the leading players’ actions are unlocking new imagination for the industry’s growth:

• Sell functions with styles and leverage “function + fashion culture + experience” to create a new paradigm for outdoor brands.

• Leverage a diversified product matrix to meet the diversified needs of consumers. Chinese emerging outdoor brands may pivot their development direction towards fashionization.

• Fashion collaboration is an application of “expanding a single outdoor scenario into multiple urban life scenarios.”

And more

For outdoor brands, functionality is always the core product attribute and consumption driver, regardless of how urgent the shift to youthfulness is or how effective fashionization is for business growth. Gore-Tex, eVent, Dermizax, and Pertex are waterproof fabrics; Polartec, Merino Wool, and Thermolite are thermal materials; PrimaLoft and Thinsulate provide warmth and water resistance. Every brand’s R&D and innovation are driven by the specific customized needs of various outdoor scenarios, such as protection, quick-drying, sun protection, cushioning, and wear resistance. Especially in the Chinese market, where outdoor consumers are returning to rationality and increasingly research-oriented, function, quality, and cost performance may still have priority over aesthetics and fashion design. However, outdoor brands’ decision-makers should be aware that the Chinese outdoor consumer market is currently split into three segments: outdoor professionals, outdoor enthusiasts, and followers of outdoorsy fashion trends, with each segment featuring different consumer ages and needs. Meanwhile, as the once-niche outdoor market gradually gains popularity, the growing consumer base has spurred several advancements in outdoor apparel, including fashionization, lightweight, and enhanced social attributes. This implies that the intersection of three major groups has the potential to become the growth engine for outdoor brands, regardless of where their core target audience is rooted. One example here is the increasing market penetration of Japanese outdoor fashion brands such as Goldwin, Nanamica, Snow Peak, White Mountaineering, and wander, and DAIWA PIER39 in the three segments in recent years. Moreover, these brands are exporting outdoor concepts and brand values through collaboration in various fields. Essentially, this is the driving influence of fashion and stylization on the brand’s functionality narrative being unleashed. It caters to consumer imaginings of the "outdoor" lifestyle, seamlessly expanding limited outdoor scenarios into diverse urban living scenes.

复制成功!