Feature 3. Footwear

The fact we embrace that diversity and (plan to) continue to expand it in the future is what makes it fun and powerful.

Andrew Rees, CEO of Crocs

Overview 2023

In 2023, the global footwear market is going through a sluggish period. In China, as offline retail bounced back, the footwear industry is gradually regaining its momentum. However, the performance of brands presents a mixed picture. ECCO, the Danish footwear brand, disclosed in its latest annual financial report a 9% growth in sales revenue in the Chinese mainland, reaching €390 million. In stark contrast, UK footwear brand Dr Martens reported a significant 55% drop in pre-tax profits in the first half of 2024 and has terminated its distributor contracts in China. In the case of Chinese domestic brands, Daphne has turned around its fortunes after years of losses, with the group’s profit attributable to shareholders increasing by 57% year-on-year as of June 30, 2023. In the battleground of the 2023 Double 11 shopping festival, Chinese footwear brand leader BELLE outperformed its competitors and claimed the top spot on the “Men’s and Women’s Shoe Store Sales Ranking”. From a market structure perspective, a wave of “lazy economy” has inundated the market, replacing sophistication with comfort. According to the US sneaker trading platform Stock X, UGG and Birkenstock, both known for their “ugly boots” aesthetics, experienced staggering triple-digit growth in transactions on the platform in 2023, registering 836% and 492%, respectively, claiming the top two positions in the footwear category. Crocs, following Dr Martens and Gucci, secured the fifth spot with a 26% growth. Data reveals that Birkenstock recorded a year-on-year increase of 21.29% in revenue to €1.117 billion over nine months ending June 30, 2023. In October, Birkenstock, valued at over $8 billion, successfully made its debut on the New York Stock Exchange. Crocs Group reported a 6.2% year-on-year growth in revenue for the third quarter of 2023, reaching $1.05 billion. The master brand Crocs’ revenue rose by 11.6% to $789 million, with the Asia-Pacific region, including China, registering a growth rate of 26.5%. Specifically, in China, the third-quarter growth exceeded 90%, calculated at a fixed exchange rate. Crocs’ consecutive growth over more than ten quarters has led the brand to raise its full-year performance expectations, with anticipated revenue of $5 billion in 2023. According to financial magazine Barron’s 2023 list of “Best-Performing U.S. Stocks of the Past 25 Years”, Deckers, the parent company of UGG and HOKA, secured the fifth spot with an annualized return rate of over 25%. Over the past 25 years, Deckers’ stock price has surged approximately 88-fold (as of December 6, 2023). The fiscal year 2023 marked a resurgence for the ever-popular brand UGG, surpassing $1.9 billion in sales.

Challenge

• Long-established traditional footwear brands urgently need to seek innovation and changes in product design and cultural relevance.

• The increasing prevalence of collaborations in the footwear industry makes it harder to create hit products.

• Trends and consumer preferences are highly dynamic, making it difficult to catch up by simply following suit.

According to Beth Goldstein, a footwear industry analyst at strategic consulting firm Circana, future consumers will prioritize essential everyday items over impulse purchases. This requires footwear brands to demonstrate their value by offering compelling expertise and design. In April 2023, a trending topic on Weibo highlighted a survey of 223 women walking past Beijing’s Guomao subway station, which reveals that less than one-tenth of them wore high heels, while most of them opted for sneakers, casual shoes, Martin boots, and loafers. Jesse Einhorn, a senior economic analyst at Stock X, noted in an interview with FootWear News that in the post-pandemic era, footwear brands have increasingly responded to consumers’ shift towards leisure and comfort. In this context, established players in the women’s footwear sector are on the brink of transformation in dimensions such as product design and cultural connections. Additionally, the intense competition in the footwear industry has led to a rush to blindly follow the trends. As commented by a media outlet: “The current lower-tier market is rife with a tendency to just follow suit, inheriting the blindness of the ‘bread shoes trend’ seen in the past and transforming into today’s ‘act as however Balenciaga does’.” Moreover, in the footwear industry, the frequency of presenting rare and exclusive products through collaborations is expected to increase in the future. However, amidst the overwhelming number of collaboration projects, most will fail to create their hotcakes and instead get overshadowed by the continuous influx of new releases.

Action

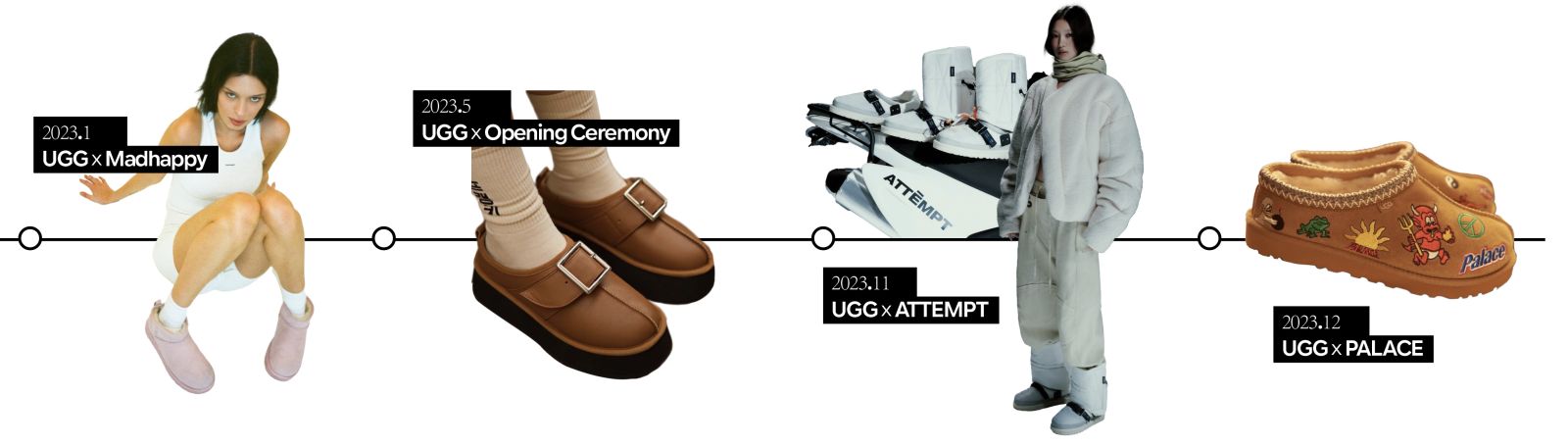

Facing an era of a zero-sum game, how can footwear brands that manage to achieve counter-trend growth carve out a well-rounded cultural ecosystem and a robust path for brand development? In 2023, the three major “ugly boot” brands—Birkenstock, Crocs, and UGG—undoubtedly emerged as the ultimate winners. The Weibo hashtag #WhichIsUglier, Crocs or Birkenstocks#, garnered over 280 million views, indicating that the “uglier” the shoes are, the more popular they may become among the fashion-forward crowd. According to statistics, Birkenstock has expanded its product offerings to over 700 styles, with 76% of its revenue generated from five classic shoe models. Since its acquisition in 2021 by L Catterton, a consumer goods fund under LVMH, Birkenstock has leveraged these five iconic models as a blueprint for collaborations with numerous fashion brands and designers, including Dior, Valentino, Gucci, Manolo Blahnik, Rick Owens, Jil Sander, Stüssy, Fear of God, BEAMS, Kith, and ADER error. According to Stock X, the Birkenstock x Stüssy collaboration, which spanned three consecutive seasons in 2023, boasted an average premium of 125% and an average resale price of $427. By consistently and frequently engaging in collaboration initiatives, Birkenstock has not only shed its label of “shoes for seniors” and created room for price premium but also transcended seasonal boundaries, becoming a beloved cross-seasonal fashion item among younger consumers. Compared to Birkenstock, the popularity of Crocs’ iconic clogs in the Chinese market is nothing short of extraordinary. As of mid-December 2023, there were over 750,000 posts about Crocs Clogs on Xiaohongshu, and the hashtag #Clogs# amassed over 890 million views. According to statistics, in 2023 alone, Crocs established over 60 global partnerships with brands, designers, celebrities, and licensors across various industries, with 25% being regional market-driven initiatives. They launched over 24 collaboration projects, diversifying their partners to include GOODBAI, MSCHF, Lil Nas, McDonald’s, POP MART, Melting Sadness, Coca-Cola, and HELLO KITTY. Furthermore, Crocs made appearances at fashion shows for brands such as Balenciaga, Simone Rocha, Feng Chen Wang, and Susan Fang through fashion collaborations. In April 2023, Crocs appointed Salehe Bembury, former designer for Yeezy and Versace, as the Creative Director of the Pollex Pod collection. Unlike Birkenstock and Crocs, UGG, which holds the top position in footwear trading volume on Stock X, places a greater emphasis on exploring collaboration opportunities with next-generation designer brands worldwide. The brand has joined forces with emerging designer labels such as Collina Strada, Ashley Williams, Cormio, Vaquera, and YUEQI QI, making appearances at SS24 fashion weeks in New York, London, Milan, Paris, and Shanghai. In October 2023, UGG extended its exploration of genderless deconstructed aesthetics in collaboration with Chinese avant-garde designer brand Feng Chen Wang. Inspired by the Chinese cultural symbol “phoenix,” they launched a fourth-season collaboration for both men and women, which generated a Weibo hashtag that garnered over 16.22 million discussions. In November, UGG collaborated with Chinese designer brands Randomevent, ATTEMPT, and STAFFONLY, aiming to expand their customer base by building their brand attraction for males. Notably, in the realm of traditional footwear brands, Clarks, a British brand with a century-long legacy, welcomed its first guest creative director in May 2023 - the British genius designer Martine Rose. Embracing the market consensus of “putting creativity back at the core and creative talents becoming a valuable asset for brands”, Clarks stepped beyond its comfort zone of “classic British leather shoes” and joined forces in 2023 with fashion and streetwear brands such as Packer, a century-old sneaker store in New York, Vandy The Pink, Supreme, sacai, and so on, in a bid to steer the brand back onto the track of growth.

GROWTH in 2024

• Collaborations allow brands to break out of the constraints of being solely focused on footwear and limited only to specific seasons.

• Long-term collaborations with creative talents and designers can enhance product offerings and elevate brand value.

• Avoid blindly following trends; creativity should always be rooted in the brand’s essence and unique identity

And more

To some extent, the successful resurgence of the three major "ugly shoes" in 2023 can be seen as an inspiring tale that "moves the hearts". In a consumer market where aesthetics and appearance take precedence, when public opinion and consumers persistently label your brand as "ugly" and "unrelated to fashion", as a brand decision-maker, do you still possess the patience, confidence, and courage to redefine your brand in this market? This is particularly challenging for many traditional footwear brands that are currently being abandoned by young consumers, representing a formidable psychological barrier and developmental dilemma. “We encourage risk-taking, out-of-the-box thinking,” said Dave Powers, CEO of Deckers, in an interview with the media, “We embrace the fact that our footwear is odd to some people, but it’s very distinctive and ownable.” Furthermore, when describing these two brands, Powers said: “UGG is a heritage brand that has been around for a long time that is beloved and stronger than ever. And then Hoka, it’s on fire…One is fashion, with steady, sustainable growth. One is performance with high growth. ” Marissa Galante Frank, a fashion editor at Bloomingdale’s, commented: “UGG does a great job of introducing timely collaborations and reinventing their silhouettes, as a way to excite consumers. Their collaborations with tastemakers are always fresh and present an unexpected twist.” When sharing insights on brand strategy, Andrew Rees, CEO of Crocs, stated: “Our success was built on a strategy to deliver long-term sustainable growth…We launched our ‘Come As You Are’ campaign celebrating the uniqueness of individuals and inspiring people to be comfortable in their shoes. We also began the era of collaborations, working with celebrities, designers, and brands to build relevance and reach new consumers…When we create brand partnerships, we are looking for three key criteria: authenticity, creativity, and relevance.” This is where Crocs shines. Instead of falling into the trap of self-validation due to existing labels, Crocs has taken the opportunity to reassess its approach, anchoring itself in its brand philosophy of “Come As You Are” and engaging in collaborations to create a space for dialogue with today’s consumers. In the meantime, the presence of a brand signifies the existence of market demand. However, before considering how to sustain the product lifecycle, are you confident that your brand already possesses a core product with both functional competitiveness and production stability? Take the Birkenstock family as an example: this family has been dedicated to crafting products using natural cork, latex materials, ergonomic design, and cork footbeds since 1774. It was exactly this history and legacy that enabled it to attract more and more people to tell Birkenstock’s own stories after breaking through traditional limitations through cross-industry collaborations. If even the three long labeled major "ugly shoes" can defy the odds and soar, what reason do we have not to create our own "brand miracle"?

复制成功!