Feature 2. Apparel

A truly excellent product must contain a kind of aesthetics. This applies not only to clothing but also to all products.

Tadashi Yanai, Chairman of Fast Retailing

Overview 2023

In 2023, the apparel industry navigated a landscape of steady yet weak recovery, marked by a mixed picture. “Navigating through challenges with prudence” has become the major tone. Fast Retailing, the parent company of Uniqlo, reported a 20.2% year-on-year increase in total consolidated revenue to ¥135.1 billion in the fiscal year 2023, with operating profit in the Greater China region soaring by 25%, setting a historic high. Inditex, the parent company of Zara, revealed in its financial report for the first half of 2023 (as of July 31) that sales of Zara and Zara Home increased by 13.1% year-on-year to €12.362 billion, constituting 73.4% of the total revenue, but the growth rate was slightly lower than the industry’s overall momentum. H&M Group recorded an 8% year-on-year increase in net sales for the first three quarters of 2023, hitting SEK 173.385 billion. Moncler Group also showed strong performance, with a 16% year-on-year increase in revenue to €1.8 billion during the same period, with the Asian market standing out in Q3, mostly driven by robust contributions from Chinese consumers. JNBY achieved a total revenue of ¥4.465 billion for 2023, representing a 9.3% growth compared to the previous fiscal year. BESTSELLER’s performance for 2023, as of the end of July, showed a 5% growth in operating income, reaching DKK 37 billion (approximately €4.9 billion). Its retail revenue saw a significant boost of 11%, while its net profit declined from DKK 5.153 billion to DKK 3.9 billion. Meanwhile, Peacebird’s financial report revealed a 16.07% year-on-year drop in revenue for the first three quarters, amounting to ¥5.223 billion, while its net profit attributable to shareholders of the parent company increased by 37.37% to ¥210 million. According to McKinsey’s data, the global fashion industry experienced a slowdown in sales growth in 2023, ranging from -2% to +3%. It noted that, in light of the fragile global economy, fashion brands need to plan cautiously.

Challenge

• Consumers are trending towards cautious spending, with apparel being considered a non-standard commodity and experiencing a significant impact.

• Fashion companies are in urgent need to accelerate their effort in diversification and style-oriented market positioning.

• “Good design, genuine fashion, high quality, and affordable prices” is gradually becoming the new consumer consensus.

In the post-pandemic era, Chinese consumers’ shift towards more rational consumption was first reflected in the apparel market. According to the 2023 McKinsey Chinese Consumer Report, “Consumers are not trading down, but they are getting much smarter about what they buy and where. Consumers are spending more conservatively, though they are doing so while making adjustments that allow them to maintain their quality of life.” Wu Pinhui, Global Executive Director of Fast Retailing Group and Chief Marketing Officer of Uniqlo Greater China, stated, “As people’s lifestyles become more diverse, there is a growing pursuit of smart fashion. With an upgraded understanding of fashion, consumers now prioritize personalized and differentiated clothing designs, making them the new favorites in the market.” In the current landscape, there is a growing consensus in the industry around “high-quality growth”. However, upon a deeper dive, we realize that for the Chinese market, which has entrenched in a prolonged period of rapid economic expansion, “high quality” and “growth” are two intertwined challenges that need to be balanced. Fan Yongkui, Chief Financial Officer of JNBY, once highlighted that the company has achieved simultaneous growth in both revenue and profit in recent years, benefiting from a favorable balance between art and commerce. Looking ahead, the company will remain committed to its design-driven core strategy and tenaciously pursue excellence in design.

Action

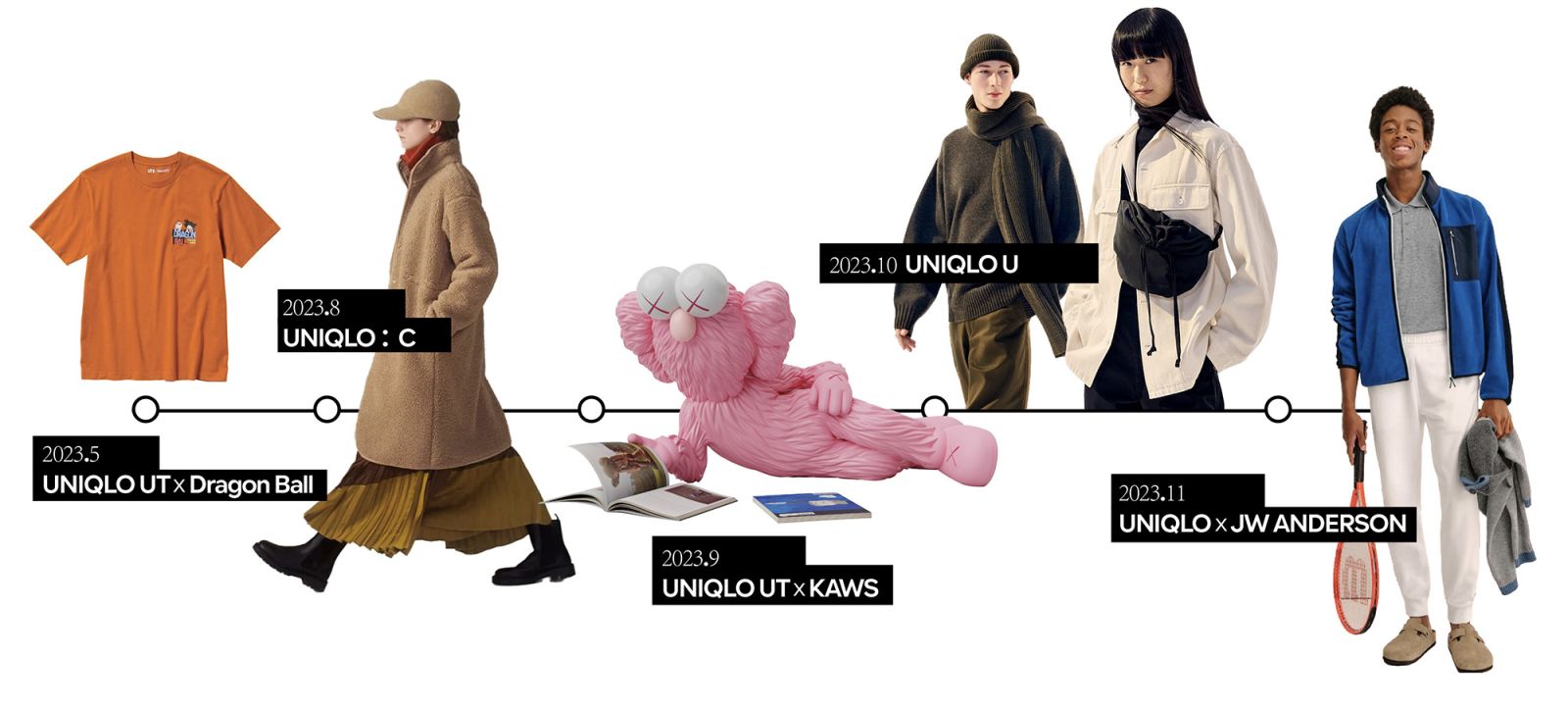

In 2023, both Uniqlo and Moncler showcased exceptional performance, but their success was not achieved overnight. In the eyes of Tadashi Yanai, Chairman of Fast Retailing Group, 2023 marks the beginning of their “fourth wave of entrepreneurship”. He stated in a news conference: “We aim to grow more than threefold in the next 10 years, too, to achieve the 10 trillion sales (target).” Uniqlo’s impressive growth in 2023 is the culmination of its long-standing efforts across multiple dimensions, including product design, channel expansion, quality control, pricing strategies, and brand value enhancements. Looking at individual products, since NIGO took over as the creative director of Uniqlo’s UT collection in 2013, he has orchestrated a cultural empire of T-shirts through collaborations with creative individuals and IPs from the realms of fashion, art, music, film, animation, and literature, making T-shirts a “cash cow” within Uniqlo’s product lineup. The highly anticipated UNIQLO UT x KAWS co-branded collection, after six successful seasons, made a triumphant return in August 2023 and quickly became a sensation, with popular styles selling over 10,000 products on Tmall by November. In terms of product series, Uniqlo has joined forces with legendary minimalist designer Jil Sander, French fashion designer Christophe Lemaire, and British fashion brand JW ANDERSON to create the UNIQLO + J collection, UNIQLO U collection, and UNIQLO and JW ANDERSON collection, offering consumers a diverse range of style options while enriching the brand’s long-lasting product matrix and creating opportunities for a price premium. In 2023, Uniqlo for the first time collaborated with Clare Waight Keller, former creative director of Chloé and GIVENCHY, to create the UNIQLO C collection, from which the popular styles recorded sales of over 10,000 on Tmall. By December, the topic “UNIQLO collaborations” on Xiaohongshu had amassed over 100,000 recommendation notes. Turning towards high-end clothing brands, Moncler has also regained its status by embracing strategic collaborations. In February 2018, Moncler unveiled the inaugural Moncler Genius collaboration project, teaming up with eight renowned fashion designers and stylists including Hiroshi Fujiwara, Simone Rocha, Craig Green, Pierpaolo Piccioli (Valentino’s creative director), Karl Templer, Kei Ninomiya, and Francesco Ragazzi (designer of Palm Angels) to roll out co-branded collections. Employing a drop-style launch approach, this project drove a 33% year-on-year increase in Moncler’s net profit during 2018, with 40% of the consumer base consisting of Gen Z and millennials, effectively revitalizing the brand. Following that, Moncler Genius has continued its momentum by collaborating with an average of 10 creative partners every year, further bolstering the brand’s performance and visibility. Moncler’s roster of creative collaborators has also expanded with the addition of designers and brands such as Matthew Williams, Richard Quinn, JW Anderson, Alicia Keys, Pharrell Williams, Thom Browne, Giambattista Valli, Rick Owens, Dingyun Zhang, HYKE, Gentle Monster, and RIMOWA. During the London Fashion Week in February 2023, Moncler collaborated with Palm Angels, Alicia Keys, Mercedes-Benz, Hiroshi Fujiwara (FRGMT), Roc Nation & JAY-Z, Salehe Bembury, Pharrell Williams, and adidas Originals for THE ART OF GENIUS, an extraordinary showcase that blended culture, art, fashion, sports, music, and entertainment. This event marked a significant milestone for Moncler Genius, elevating it from a fashion initiative to a boundless cross-industry co-creation platform, allowing the brand to carve out a new and dynamic ecosystem to thrive.

GROWTH in 2024

Amid the intricate competition in the Chinese apparel market, the remarkable performance of Uniqlo and Moncler, as evidenced by their simultaneous growth in sales and visibility, sheds light on important insights:

• The ability to achieve differentiation through design and aesthetics is the key driver for apparel brands and an enduring challenge in brand development.

• Creating perfect products takes time and effort; collaborations that are the right fit hold more long-term value than simply pursuing big names or big scales.

• Sustaining strong product offerings and cultivating brand power are among the most crucial strategies for apparel brands.

And more

Uniqlo and Moncler are undoubtedly long-termists in terms of fashion collaborations in the apparel industry. For both fast-fashion and traditional apparel brands, Uniqlo’s product strategy carries significant value and inspiration. Building upon comfortable and functional fabrics, Uniqlo goes a step further by leveraging cultural and fashion narratives to refine its fashion styles through long-term collaborations with diverse fashion designers. This approach enriches the brand’s product lineup and elevates its products from “basic products” to “iconic items”. By offering “well-designed, high-quality, and affordable” choices to consumers with different style preferences, Uniqlo successfully enhances its price premium potential and brand strength. Amid unpredictable fluctuations in the macroeconomic landscape, Uniqlo’s long-term strategy has already prepared itself to cater to two distinct consumer groups: those who have high demands for quality and fashion design but are trading down, and those who are price-sensitive but increasingly favor design and stylization and are upgrading their consumption cautiously. More importantly, each collaboration serves as a hands-on training opportunity for Uniqlo’s talent team, as “cognition” has always been an invisible competitive weapon for brands and corporations. For high-end fashion brands, the original intention expressed by Moncler Chairman and CEO Remo Fuffini when discussing the Moncler Genius strategy remains relevant today. “You cannot talk to your customer every six months; you need to talk every day. I hope the Genius strategy will get young kids, a young generation, talking about Moncler around the world.” However, as mentioned earlier, the success of Uniqlo is not solely attributed to its fashion collaboration strategy. We should also recognize the growth drivers behind their other initiatives such as expanding store openings and raising employees’ salaries. In the ever-evolving landscape of the fashion industry, where the mantra "product is king" reverberates, have you, as decision-makers or product leaders of a brand, and your team prepared yourselves to revisit and learn anew the course that spans "marketing through collaborations to corporate strategies of cross-disciplinary co-creation"? Sometimes, the truth is never intricate; it's just that humanity has complicated it. Simple tasks, when done repeatedly, consistently, over the long term, may evolve into something not so simple. Just as the saying goes: “You knew it, but we did it.”

复制成功!